The 2025 Automotive Finance Canada conference (February 11th, Toronto) will focus on Driving the Future of Auto Finance by tackling the sector’s most pressing issues: fraud, digital transformation, macroeconomic shocks, remarketing, and underwriting. The event will provide attendees with next-generation insights and actionable solutions for adapting to changing consumer behaviour and mitigating operational risk.

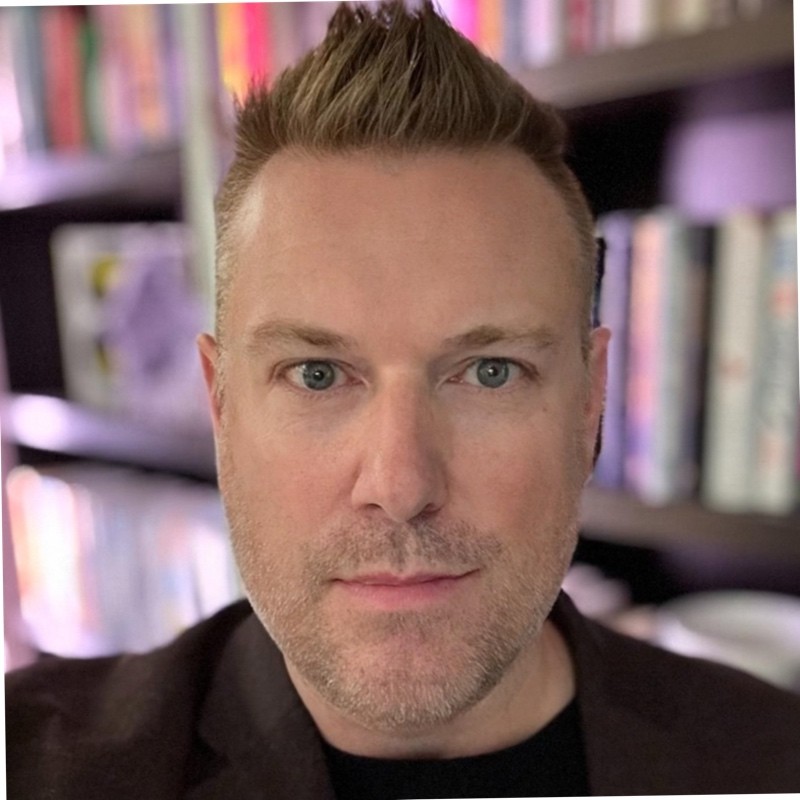

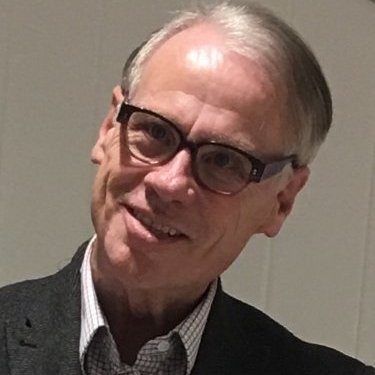

The summit is for Senior Executives and decision-makers across the financial and auto ecosystem, including leaders from major Lenders (Banks, Credit Unions, Auto Finance Companies), Insurers, and Fintechs. Professionals in Operations, Risk Management, and Digital Strategy will gain critical intelligence from an executive speaker lineup for strategic planning and forging essential industry partnerships.