Welcome to The Future of Lending™.

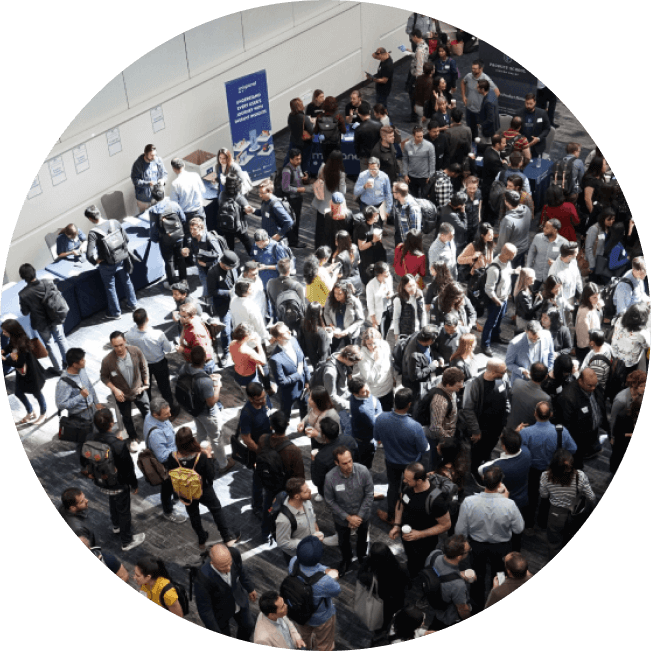

From banks and alternative lenders to best-of-breed vendor from the fintech ecosystem, the Summit is the hub for innovation across all consumer and commercial sectors. On November 6th, 2024, network with over 600 industry executives. (See last year’s sold out event.)

2024 Speakers

-

Jason Mullins

CLA Vice Chair | CEO

-

Michael Fox

CRO

-

Bob Dugan

Chief Economist

-

Michael McGhee

SVP & Head, TD Auto Finance Canada

-

Sue Noble

VP, Commercial Financial Services Strategy

-

Mona Afzal

Global Director | Head Enterprise Growth

-

Scott Morrison

President & Managing Director

-

William Tsutsumida

Chief Credit Risk Officer

-

Amir Tehrani

Head of BMO Home Financing

-

Michael Garrity

Chairperson

-

Kevin Carmichael

Editor-at-Large

-

Martin Nel

EVP & CRO

-

Hamed Arbabi

CEO | Founder

-

Wayne Pommen

Chief Revenue Officer

-

Jessica Moffat

General Manager

-

Lauren Thompson

VP Specialty Finance

-

Hamid Akbari

CEO

-

Misha Esipov

CEO

-

Akash Goyal

Managing Director, Debt Capital Markets

-

Ryan Brinkhurst

CEO | Founder

-

Lora Paglia

SVP, Chief Risk Officer

-

Tal Schwartz

General Partner

-

Casper Wong

CEO

-

Brent Reynolds

CEO | Founder

-

Jason Appel

CRO

-

Zack Fuerstenberg

SVP, President Credit Union

-

Rasha Katabi

CEO | Founder

-

Nicky Senyard

Founder

-

Thomas Becher

Head of SME Banking

-

Arina Eremina

SVP Portfolio Risk

-

Noah Buchman

President | Co-Founder

-

Amit Sadhu

SVP, Risk

-

Bill Johnston

SVP Product & Innovation

-

Mickey Mingov

Managing Director

-

Pamela Dodaro

VP | Chief Product Officer

-

Matt Connors

Financial Services

-

Sumit Sarkar

Head, Customer Growth, Segment & Value Prop

-

Scott Satov

CEO | Founder

-

Cindy Zhang

Payments | Cards | FinTech

-

Matthew Browning

President

-

Naga Parvatharajan

CEO

-

Paul Edwards

Director, Risk Decision Sciences

-

Thomas Oddie

Vice President, Data and Analytics

-

Vaishali Mohan-Hollands

VP Product and Support

-

Richard Valade

President

-

Karim Nanji

CEO

-

Gary Schwartz

President | CEO

-

Holly Heglin

Head of AI Product & Strategy

-

Christopher Zaki

SVP, Head of Capital Markets

-

Adeline Cheng

Partner, Risk Consulting

-

Collin Galster

COO

Sponsors

2024 Agenda

8:00 am - 5:40 pm

Rate Expectations: Balancing Risk When Interest Dips

Analyze the delicate balance between risk and reward in a declining interest rate environment. This panel will explore strategies for maintaining profitability while managing credit risk, and offer insights into adapting lending practices to new market conditions.

Everything You Always Wanted to Know About AI* (*But Were Afraid to Ask)

Workshop: What is an AI-driven credit journey and how can “trustworthy AI” help get us there faster? Join the head of AI Product & Strategy at Layer 6 AI a TD Bank Company, cut through the AI hype to deliver tactical strategies and real-world applications that are reshaping lending today. Unlike the high-level AI overviews seen at other events, this workshop dives into actionable insights, exploring how data-driven algorithms, predictive analytics, and automation can streamline underwriting, enhance risk assessment, and improve customer experience. Join Holly and Jesse to workshop how lenders can strategically implement AI to drive measurable results, mitigate risks, and gain a competitive edge in a rapidly evolving financial landscape.

Next-Gen SMB Lending: Why ‘Business as Usual’ Won’t Cut It

Stay ahead with the latest innovations in business lending. This panel will showcase cutting-edge technologies and strategies that are transforming the sector.

Cover Your Assets: A New Look at Creditor Insurance

Discover the benefits of creditor insurance and how it can be leveraged to mitigate risks. This panel will cover best practices and innovative uses of this financial tool.

The Innovator’s Dilemma: Risk on the Edge

For lenders, launching new products and technology is a balancing act, where the risk of not innovating must outweigh the risk of poor implementation. On this panel we hear from a major bank, a MFC, and an alternative lender on how to undergo transformation the right way.

Regulatory Rundown: RPAA, Open Banking, Rate Cap, AML

Workshop: Join industry leaders as they unpack the latest developments in Canada’s regulatory landscape, including the Retail Payments Activities Act (RPAA), Open Banking initiatives, rate cap regulations, and Anti-Money Laundering (AML) requirements. This panel will provide insights into how these evolving policies impact lenders and offer strategies for compliance and growth in a shifting regulatory environment.

Borrowing in the Background: The Age of Embedded Credit

Embedded lending integrates credit directly into non-lending platforms, allowing businesses to offer financing options seamlessly within their ecosystems. This panel will explore how companies across industries are embedding lending into their customer experiences, the benefits of this approach, and the technology driving it.

Credit Modelling 101: Credit where Credit’s Due

How has traditional credit scoring evolved in the age of alternative data? We will delve into the practical aspects of implementing new score and underwriting workflows, and compare it with traditional decisioning processes. We will examine everything from infrastructure to best practices.

How to Exit in the North: Discussing Fintech Funding in Canada

Join us for a conversation with Michael Garrity, Partner at Exit North Ventures, an early stage Canadian fintech VC fund. We’ll unpack how he raised venture capital for one of Canada’s largest alternative lenders and then later sold his company. We’ll also discuss what Canada needs right now in order to build successful global businesses.

Auto Correct: Where should Automotive Lenders be Investing in 2025?

Discover the cutting-edge technologies and strategies transforming automotive finance. This panel will cover advancements in digital lending, AI-driven credit assessments, and evolving consumer preferences, reshaping how vehicles are financed and purchased. Sponsored by our February 2025 Auto Summit: Automotive Finance Canada

How to Compete for and Win High-Quality Leads

Workshop: Explore strategies for attracting and securing high-quality leads in the competitive lending market. Learn from industry leaders about effective marketing and acquisition techniques.

Clicks to Commerce: The Future of POS Lending

Discuss the trends and technologies shaping the future of Point-of-Sale (POS) lending. Understand how this space is evolving and what it means for merchants and consumers alike.

Raising Credit Facilities as Rates are in Flux

Gain insights into strategies for raising credit facilities amidst fluctuating interest rates. Experts will share their experiences and best practices for navigating these challenges.

Credit Beyond Borders: How to Underwrite Newcomers to Canada

Learn how lenders are using international credit bureau data to underwrite new-Canadians. This panel will explore innovative ways to assess creditworthiness for newcomers, helping them access credit faster and more effectively.

Risk and Reward: The Growth of Card Programs

This panel will explore best practices in card program design, customer engagement, and leveraging new technologies, while balancing risks in the sector. Learn how to enhance user experience, increase card adoption, mitigate fraud and credit risk, and maximize profitability in a competitive market.

Details

Date

November 6th, 2024

Time

8:00 am – 5:40 pm

Venue

The Quay, 100 Queens Quay E 3rd Floor, Toronto, ON M5E 1V3

Sign up for our newsletter

Join over 5 thousand fintech and lending executives who read our monthly news briefing.