2023 Fraud Technology Half-Day Workshop

The Fraud Technology Workshop will provide attendees with information about the technologies that can be used to satisfy the requirements of the Government Issued ID Method, the Credit File Method, and the Dual Source Method as well as how these technologies can combat fraud.

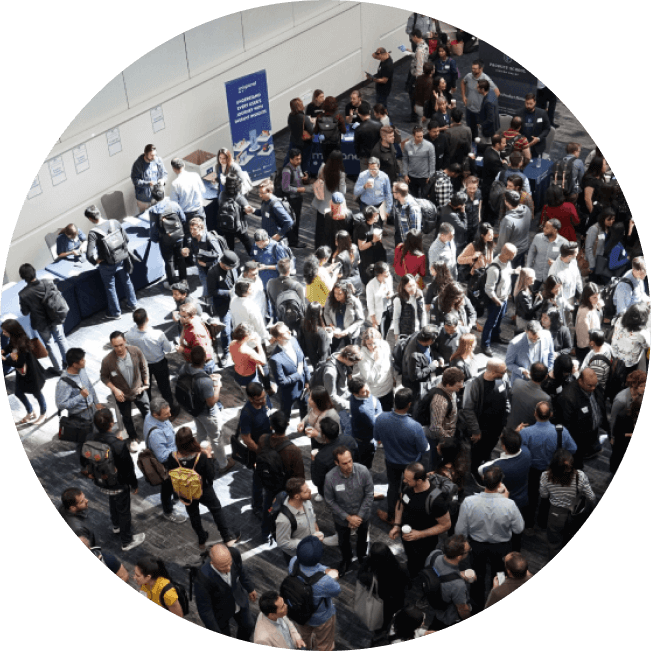

This half-day workshop is part of the Lenders Summit and ALL participants will have access to the Lenders Summit networking and content from 9:00 – 5:00 on November 1st including breakfast, lunch and evening drinks.

Speakers

-

Dominique Samson

VP, Corporate Affairs

-

Untitled

-

Almis Ledas

President & COO

-

Giles Sutherland

VP Business Development

-

Erik Jilnö

Product Manager

-

Patrick Boudreau

Head, Identity Management & Fraud Solutions (Canada)

-

Krista Saarinen

Fraud and Risk Management Director

-

Hussein Ezzat

Consultant - Fraud Prevention & Identity Management

-

Nathan Spaling

CEO

-

Leigh Day

Digital Identity Consultant

-

Gene DiMira

Global Head of Revenue & Partnerships

Sponsors

Agenda

8:30 - 1:00

Registration and Breakfast

State of the Union and Regulatory Brief

Mini Keynote: Overview of the FINTRAC Client ID Rules and the equivalent rules governing lawyers as well as recent developments related to the Client ID Rules.

-

Untitled

Using Photo ID and Selfie for Remote Identity Verification

Panel: The goal of this segment is to give attendees an understanding of the vendors offering Document Authentication Technologies & Liveness Detection/Genuine Presence Assurance Technologies, how the various technologies work, and the pros and cons of each technology.

This segment will also provide information about government issued Digital IDs including which governments are planning on issuing digital IDs, how the IDs work and when the governments will start issuing the IDs.

-

Untitled

Network Break

Enstream – Cell Phone Account Verification

Dual Source Method II: The goal of this segment is to provide attendees with information about how the Enstream platform works, the value of cell phone account information to fraud prevention and how the Enstream platform can be accessed.

Flinks Network Break

Real-World Application of These Technologies

Case Study: The goal of this segment will be to present a case study on the Treefort digital ID, electronic signature and virtual meeting platform including discussions on:

- How are these technologies used?

- How Canadians are reacting to these technologies?

- Why Multi-Factor Authentication is required in order to materially mitigate the risk of fraud?

Lunch & Lenders Summit Afternoon Session

Lunch is served and participants are welcome to join the Lenders Summit downstairs.

<<– agenda

<<– agenda

Details

Date

November 1, 2023

Time

Venue

MaRS Discovery District

101 College St, Toronto, ON M5G 1L7

Sign up for our newsletter

Join over 5 thousand fintech and lending executives who read our monthly news briefing.