On May 15th, 2024, discover how next-gen FIs are partnering with fintech to accelerate innovation.

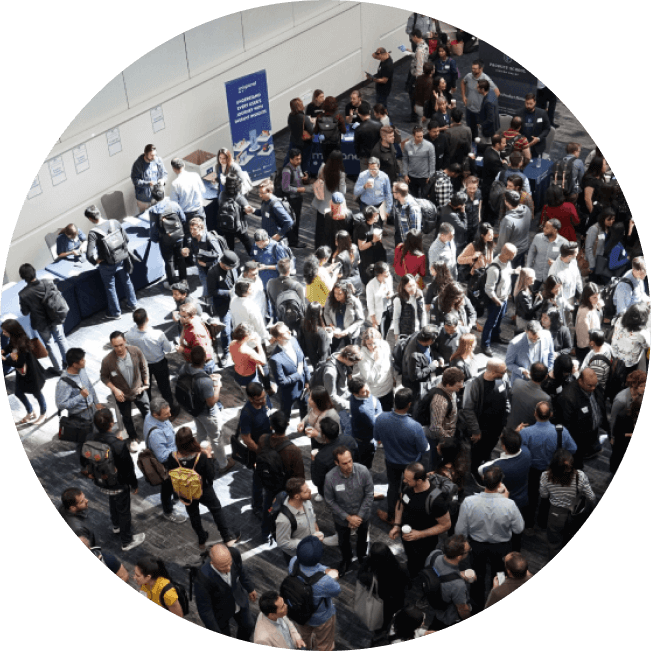

Join over 500 banks, credit unions and fintechs in our networking hall building partnerships. The expert panels will take a deep dive into BaaS, AI, Risk, Fraud, InsurTech and much more.

Speakers

-

Peter Aceto

Bank Transformation

-

Stephen Smith

Chairperson

-

Diederik van Liere

CTO

-

Mahima Poddar

Group Head

-

Rob Khazzam

CEO | Founder

-

Stephen Murphy

Group Head

-

Baanu Ratneswaran

Head, Enterprise Innovation

-

Baiju Devani

SVP/VP AI

-

Jeremy Bornstein

CRO

-

Armando Benitez

MD & Head AI & Quantitative Engineering

-

Christine Day

Chief Technology & Information Officer

-

Jennifer Arnold

CEO

-

Amit Sadhu

SVP, Risk

-

Jean Amiouny

CEO | Founder

-

Kevin Carmichael

Editor-at-Large

-

Robin Stewart

Head, Business Banking Operations

-

Carol Brigham

Managing Director, Supervision

-

Brent Reynolds

CEO | Founder

-

Parijat Sinha

Head of Ecosystem Products | GM

-

Thomas Purves

Principal, Financial Services

-

Hamid Akbari

CEO

-

Ardalan Shojaei

Chief Credit & Risk Officer

-

Curtis Gergley

Chief Risk Officer

-

Derek Szeto

Founder CEO

-

Nav Anand

Head of Solutions Architecture

-

Jackie Shinfield

Financial Services | Regulatory Compliance

-

Kevin Sampson

President

-

Noah Buchman

President | Co-Founder

-

Kim Krushell

Co-Founder

-

Leigh Day

Digital Identity Consultant

-

Anne-Marie Kelly

Head of Fraud

-

Cheryl Woodburn

Country Manager

-

Lora Paglia

SVP, Chief Risk Officer

-

Chris Brophy

Principal Risk - Banking / Financial Services

-

Moe Assaf

President

-

Hanna Zaidi

VP, Payments Strategy & CCO

-

Catharine Dutt

Enterprise Risk Services Partner

-

Nezihe Aquino

CEO | CRO

-

Kris Hansen

CRO

-

Evan Chrapko

CEO | Founder

-

Cato Pastoll

CEO | Founder

-

Stefanie Marotta

Banking Reporter

-

Yvette Wu

CEO | Founder

-

Annaleigh Greene

Managing Director

-

Yassir Jiwan

Financial Services & Insurance

-

Fabian Serrato

SVP Model, Data & AI Risk

-

Aaron Carter

Executive Director, Global Collateral Finance

-

Michael Garrity

CLA Board | Chair

Sponsors

Agenda

8:00am - 6:00 pm

Continental Breakfast

Network

Use the Bankers Summit App to setup meetings in the networking hall throughout the day. Scan personalized QR codes on your lanyard to network and schedule more effectively. Numbers in the app correspond with numbers on the networking hightops.

Treasury Island: $90B in Banker’s Acceptances set to transition

Grab your coffee and head to a discussion on the end of BA. With Banker Acceptances exiting and a tri-party repo system emerging, where will this money move?

-

Kevin Sampson

President

TMX | CDS

Speaker

Beyond Recognition: A Cautionary Tale of AI and Identity Fraud

Learn how bad actors are creating generative AI deep fake videos, audio, and synthetic IDs that are impossible to detect both in person and virtually. Easy-to-access technology is changing the identity verification landscape.

The Great Canadian Catch-up: Tech as an Enabler

A discussion on the technology that will transform Canadian banking services from microservices through to Open Finance.

Off the Rails

Jeremy Bornstein, who scaled retail payments innovation at RBC and built payment dispute deflection solutions from zero to tens of millions at Mastercard, walks us through the next revolution: real-time payments and tremendous benefits it could bring the financial sector in Canada.

A 60 Minute Playbook to Scale AI within Financial Services

Insight on Oversight: Regulating Canada’s Financial Infrastructure

-

Carol Brigham

Managing Director, Supervision

Bank of Canada

Speaker

Finance Award Winners Announced

The Tiffany & Co Award presented to individuals and companies:

Risk Officer of the Year

-

EQ Bank

Sponsored by EQ Bank

Details

Date

May 15th, 2024

Time

8:00 am – 6:00 pm

Venue

The Quay, 100 Queens Quay E 3rd Floor, Toronto, ON M5E 1V3

Sign up for our newsletter

Join over 5 thousand fintech and lending executives who read our monthly news briefing.