May 17th, 2023. We are building a new bank. What will it look like? How can next-gen FIs partner with fintech to accelerate innovation?

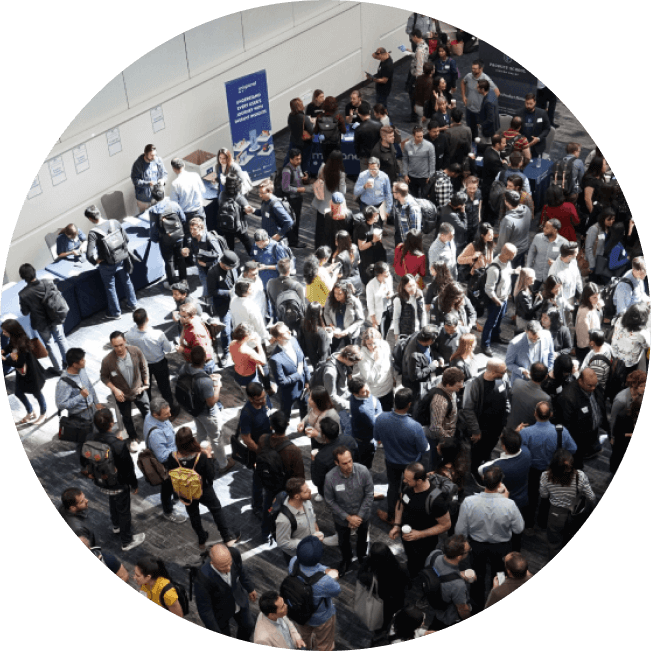

Join over 500 bankers and fintechs in Toronto on May 17th to grow your network and take part in the future of banking!

Speakers

-

Gayle Ramsay

Head, Everyday Banking, Segment & Customer Growth

-

Daniel Eberhard

Founder CEO

-

Jeff Adamson

Co-founder

-

Hanna Zaidi

VP, Payments Strategy & CCO

-

Angela Sim

Chief Technology Resiliency, Experience, Operations Officer

-

Cyrielle Chiron

SVP Strategy

-

Shivanki Singh

Senior Director, PayPlan

-

Liz Billyard-Armstrong

Chief Risk Officer

-

Jonah Chininga

Founder

-

Martin Basiri

Founder

-

Stephen Uwazota

Sustainable Finance

-

Abdullah Choudhry

Founder

-

Randeep Purewal

Founder

-

Tracy Molino

Counsel

-

Mohamad Sawwaf

Founder

-

Matthew Ayearst

Sustainable Finance

-

Kris Hansen

CTO

-

Lawrence Krimker

CEO | Founder

-

Cheryl Woodburn

Country Manager

-

Brian Weiner

VP Head of Product | Digital

-

Gary Schwartz

President | CEO

-

Stephanie Hughes

Finance Reporter

-

Chris Matichuk

Chief Technology Officer

-

Jeremy Kronick

Dir., Monetary & Financial Services

-

Mark Newman

CEO Founder

-

Derek Szeto

Founder CEO

-

James Nauss

Head of Product & Strategy

-

Nicole Hunter

Chief Commercial Officer

-

John Trivieri

CRO

-

Joshuah Lebacq

Principal, Venture Capital

-

Mena Bellofiore

Partner

-

Andrea Neufeld

COO

-

Eddy Ortiz

VP, Innovation

-

Mostafa Elhefnawy

GM

-

Kevin Carmichael

Editor-at-Large

-

Morgan Toane

DE&I Lead

-

Mauricio Deutsch

Banking Canada

-

Amit Sadhu

SVP, Risk

-

Brendan O’Driscoll

Chief Product Officer

-

Barry O’Connell

Managing Director, Americas

-

Damien Charbonneau

Co-Founder

-

Heather Kay

Financial Services Public Policy

Sponsors

Agenda

8:00 am - 5:00 pm

Challenger Accepted

Fireside | New Banks: Setting the stage for the day, Kevin Carmichael, the Editor-in-Chief of the Financial Post will sit down with senior executives from KOHO, Wealthsimple and Neo Financial to discuss key themes that will reappear during discussions on and off the stage.

Neobanks are shaking up the traditional banking landscape in Canada, offering innovative products and services that appeal to younger, tech-savvy consumers. These FIs are leveraging technology and digital channels to provide a more streamlined, customer-focused banking experience, and are increasingly becoming an important player in the Canadian financial services industry.

-

James Nauss

Head of Product & Strategy

Neo Financial

Speaker

Product (R)evolution

Panel | Product Partnerships: We follow the process of launching a new product from idea to implementation. Follow the fascinating journey of evaluating and assembling partnerships to create a net new fintech product inside a bank.

Money Does Grow on Trees!

Workshop | Sustainable Finance: With COP ecosystem commitments, companies will finally need to have the systems in place to measure and report on their Scope 3 impact. To date, the banking sectors’ response has been ad hoc. Is there a framework for the future? Workshop with experts on how to best position your company. (Upper Level)

-

Yingzhi Sarah Tang

Research Associate

Institute For Sustainable Finance

Moderator

BaaS to the Future

Panel | BaaS: In recent years, Banking as a Service (BaaS) has emerged as a key disruptor in the financial services industry globally. What is the Canadian landscape and how can BaaS accelerate banking services as more companies seek to offer financial products and services to their customers in 2024?

Decisioning in a Downturn

Mini-Keynote | Underwriting Insights: Thriving in a downturn requires greater diligence and skill than during more favourable economic times. What risk decisioning capabilities and partnership can be deployed internally and cascaded externally?

Lending Deep Dive

Panel | Lending: The lending industry is facing an increasingly turbulent macro-economic headwinds. With rising interest rates, global trade tensions, and political uncertainty abroad and at home, how are lending companies navigating with innovative decisioning technologies, sophisticated risk assessment techniques, and strategic business tactics?

Network Lunch

Changing Work for Good

Workshop | DE&I: Approaching diversity, equity, and inclusion (DE&I) requires a multifaceted strategy that involves analyzing, planning, and implementing change across all levels of an organization. At its core, DE&I is about creating an environment where a diverse group of individuals feel they have a voice and a seat at the table. Addressing DE&I is a very human problem that requires both qualitative research and quantitative metrics and KPIs; and while DE&I cannot be reduced to numbers alone, data can be a powerful tool to gain insight into an organization’s climate of inclusion. This session will be a deep dive on how FIs and fintechs can collect and analyze DE&I data to measure progress, identify areas for improvement, and hold leaders accountable for outcomes. (Upper Level)

New-to-Canada

Panel | Servicing New Canadians: This panel discussion will explore how financial services providers are adapting to meet the needs of the growing demographic of new-to-Canada (immigration) and new-to-credit (youth). Our expert panelists will discuss the latest trends and innovations this sector, including products tailored to the needs of foreign students and new immigrants. This is such a fascinating panel and core to everyone business strategy in 2024.

Avoiding Speed Bumps

Workshop | Policy: Blakes will run a policy workshop on how best to navigate regulation in a fast-moving Canadian market providing insights, and discussing strategies to adapt to the ever-changing regulatory environment. We will discuss new regulatory developments, emerging challenges, and best practices for compliance. Participants can explore topics such as anti-money laundering regulations, data privacy laws, consumer protection rules, and cybersecurity standards. By engaging in this workshop, financial companies can gain a better understanding of the regulatory landscape, enhance their risk management capabilities, and build networks of collaboration and support. (Upper Level)

Core Values

Panel | Modernizing Core Banking: Leaders in core banking solutions explore how banks should be thinking about modernizing their core stack and integrating with new sources of data.

-

Mauricio Deutsch

Banking Canada

GFT

Speaker

Build vs. Embed

Panel | Embedded Finance: By embedding financial services into other applications and services, such as e-commerce platforms, social media apps, and even cars, we are moving towards a future where financial services are seamlessly integrated into our daily lives. This will result in a more personalized, convenient, and efficient financial experience for consumers, as they will be able to access financial services whenever and wherever they need them. Embedded finance creates new revenue streams without interrupting the consumer journey.

Can I buy you a beer?

Networking Drinks

Details

Date

May 17, 2023

Time

8:00 am – 5:00 pm

Venue

MaRS Discovery District

101 College St, Toronto, ON M5G 1L7

Sign up for our newsletter

Join over 5 thousand fintech and lending executives who read our monthly news briefing.